Is investing through an SIP better than investing one-time?

Now, what if you have some accumulated savings? Should you still start an SIP and invest the money over time? Not really. Equity investments give good returns over the long-term. So, it makes sense to invest immediately instead of keeping the money idle in a bank account. Systematic Investment Plan (SIP) has become the buzzword in mutual fund investments. Before we compare an SIP to a one-time investment, let’s understand what an SIP actually does for you.

SIP helps you average your costs.

An SIP invests a fixed amount periodically (usually every month) regardless of the NAV or the market. This means that the investor buys more units when the market is down and fewer units when the market is up. This helps in averaging the overall cost of the investment. This is called Rupee Cost Averaging- you finally end up paying an average price (not high, not low) when you look at your investment over time.

Suppose you purchase 100 units of a mutual fund for Rs.10 today. Next month the price of the same mutual fund is down to Rs.8 and now you can purchase 125 units with the same Rs.100. Your average cost becomes Rs.8.89.

Timing the market is a fairy tale.

While making a lump sum investment, it’s common for investors to think about how the market is doing. Some tend to delay investing in expectation of some news or market movement. Timing the market is a challenge even for professional investors. You can only imagine how difficult it is for novice investors. In fact, when investors try to time the market, they are much more likely to buy and sell at the worst times.

SIP removes the question of when to invest. You can invest without worrying too much about whether it’s a good time to invest because in the long run your costs average out and equities, in general, tend to give good returns.

Here’s something interesting we did.

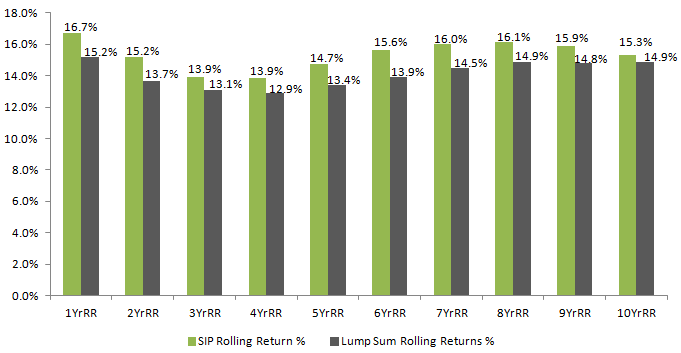

We decided to look at past data to see what gave better returns- SIP over a given period of time or one-time investment at the beginning of that period. So, we picked up SENSEX data from 1997 till 2016 and calculated the rolling returns across different holding periods. That is, to arrive at a mean return for a 3 year holding period, we picked up every possible 3 year period between 1997 and 2016 and calculated an average. It’s interesting to note that returns from SIP investments turned out to be higher in every scenario, even if it is only by around 1%.

So, does that mean SIP is the way to go?

- If you are a salaried person with money coming in once a month, then SIP is definitely a better choice. This way you invest the money as soon as it comes in, instead of sitting on idle cash for too long and figuring out when to invest.

- If you (or rather your advisor) have a strong reason to believe that markets might not do well in the near term, starting an SIP with your accumulated savings might be a better idea. This way, even if the market does fall within a few months of your investing, you would have invested only a portion of your savings which will average out over time. And if the market doesn’t fall, you would have started investing anyway.

- If you are not comfortable with the idea of investing, SIP is a good way to start. It will help you take the emotion out of investing by letting you do it in a controlled manner.

Now, what if you have some accumulated savings? Should you still start an SIP and invest the money over time? Not really. Equity investments give good returns over the long-term. So, it makes sense to invest immediately instead of keeping the money idle in a bank account.

Conclusion: SIPs and one-time investments should not be viewed in isolation. You have to choose between the two based on your income flow and outlook towards investments.